1800 841 367

ATTENTION: Commercial Property Owners and Business Owners

GET UP TO $500.00 OFF YOUR CURRENT POLICY PREMIUM

No Call Centres - Australian Based Advice - Award Winning Claims Management - Qualified and Experienced Brokers

Expertise and understanding in your insurance risks - Empower your commercial ventures with

tailored insurance solutions and expert guidance from

My Insurance Broker

CLICK BELOW TO WATCH FIRST!

Next Step: Complete The Form Below & One Of Our Qualified Senior Brokers Will Call You Right Away!

CLICK BELOW TO WATCH THESE VIDEOS AND LEARN MORE!

For Commercial Property Owners & Business Owners who need more from their INSURANCE

REDUCE ANNUAL PREMIUM INCREASES - CLAIMS ADVOCACY - PREVENT UNDERINSURANCE

COMMERCIAL PROPERTY OWNERS

BUSINESS OWNERS

ASSET MANAGEMENT

NO CALL CENTRES

AUSTRALIAN BASED ADVICE

EXPERT CLAIMS MANAGEMENT

STILL NOT SURE?

Frequently Asked Questions

Here's what we usually get asked

How do your risk management strategies help clients reduce their premiums?

We proactively help identify and mitigate risks that helps reduce the frequency and severity of claims leading to reduced premiums. Additionally, our thorough risk assessments and benchmarking analyses enable us to negotiate favourable terms with insurers, resulting in more competitive premiums for our clients.

How do you determine the appropriate level of coverage for each client?

We take a comprehensive approach to determining the appropriate level of coverage for your commercial property or businesses. This includes conducting a thorough risk assessment, considering factors such as the nature of your risk, industry regulations, potential liabilities, and the value of your assets.

Based on this assessment, we provide recommendations for coverage that align with your risk tolerance and business objectives.

How often do you conduct reviews of my insurance coverage, and what does this entail?

We conduct regular reviews of your insurance coverage to ensure that it remains aligned with your evolving needs and objectives. During these reviews, we assess any changes in your properties or business operations, industry regulations, or risk exposures that may necessitate adjustments to your coverage.

We also review your claims history and market conditions to identify opportunities for cover optimisation.

What factors do you consider when remarketing insurance policies?

When remarking insurance policies for your commercial property or business, we consider various factors such as changes in your risk exposure, claims history, market conditions, and available coverage options.

Our goal is to ensure that you have the most suitable insurance policy available, so we explore different options and negotiate with insurers on your behalf to secure optimal coverage.

What types of commercial properties do you specialise in insuring?

We specialise in insuring a wide range of commercial properties, including retail spaces, industrial facilities, warehouses, offices, and more. We also have the trust of local Commercial Property managing agents to look after their clients properties.

Our expertise extends to various tenancies, ensuring that we can tailor our insurance solutions to meet the unique needs of your commercial property.

Can you explain the process of claims advocacy and the benefits?

Claims advocacy is a core aspect of our service, aimed at representing your interests throughout the claims process. We act as your advocate, liaising with insurers, assessors, and other stakeholders to ensure that your claims are handled fairly and efficiently.

This proactive approach helps expedite claim settlements, minimises disruptions to your business operations, and maximises your recovery.

How We Get RESULTS

Step 1 - Analyse

We first review your current risk profile and assess your exposure to risk

Step 2 - Research

We then explore the market to find suitable insurance options tailored to you

Step 3 - Review

We conduct regular reviews to ensure your insurance coverage meets evolving needs and remains cost effective

Ready to get started?

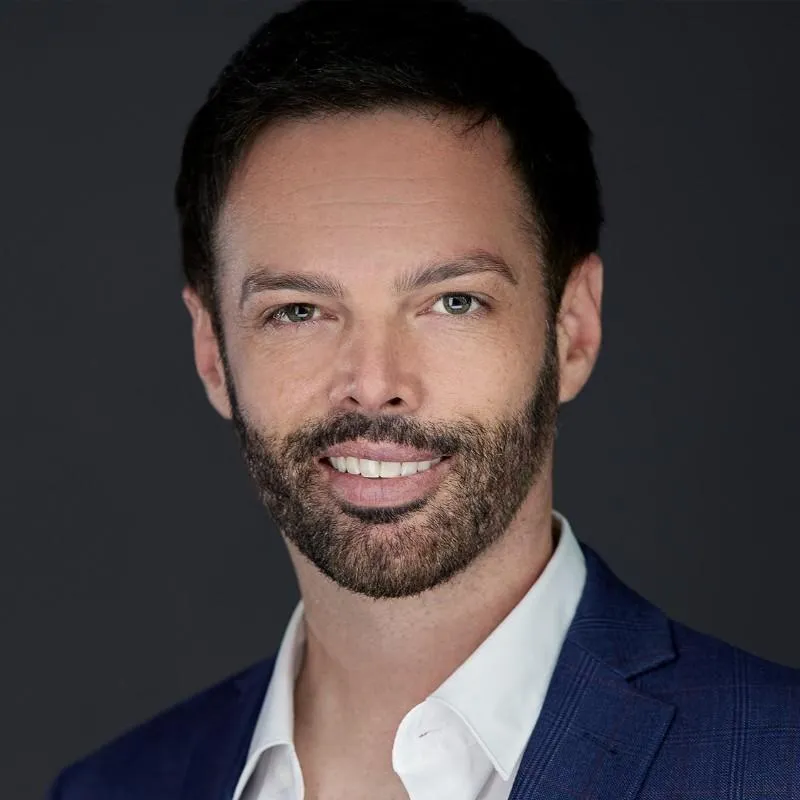

MEET THE FOUNDER & CEO

Damien Davey

Principal Broker

NIBA QPIB

ANZIIF (Snr Assoc) CIP

Dip Fin Services (Broker)

Steadfast Broker Network